Building insurance: The fundamentals

Becoming a homeowner is a big milestone and will likely be one of your largest (and longest) financial commitments, but this asset is constantly exposed to unforeseen risks from the weather, accidents and structural failures.

Dealing with damage can be financially draining and emotionally exhausting, which is why building insurance is essential for protecting your investment. Here’s a closer look at what this vital insurance entails and how it safeguards your long-term financial wellbeing.

Understanding your building insurance

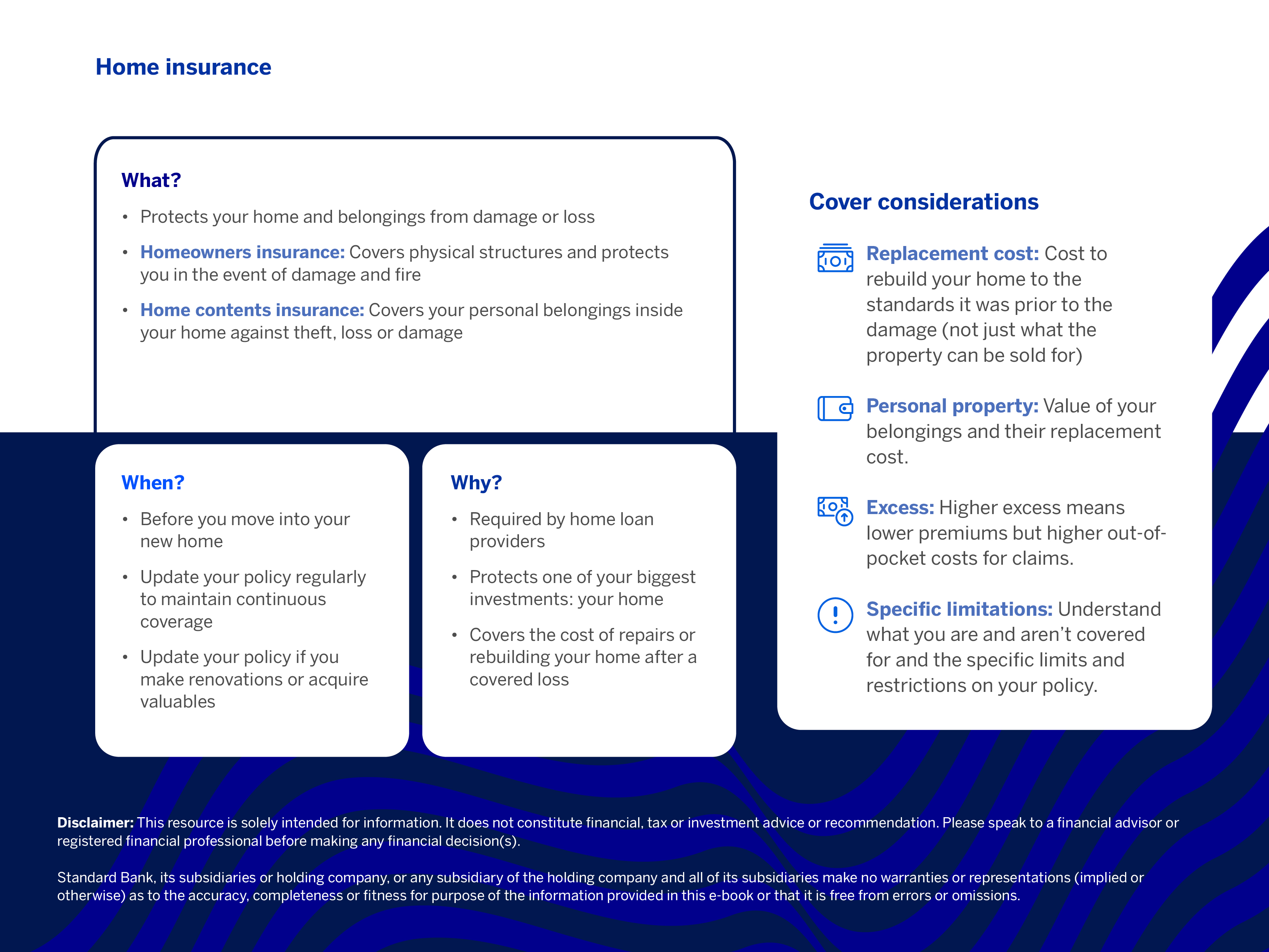

Building insurance primarily covers the physical structure of your home, meaning the walls, roof, outbuildings, garage, gates and fixed fixtures such as built-in cupboards or fitted kitchens.

It's crucial to distinguish this from contents insurance, which protects your personal belongings and movable items inside the home. The core purpose of building insurance is to help you repair or rebuild your property after damage, preventing significant out-of-pocket expenses.

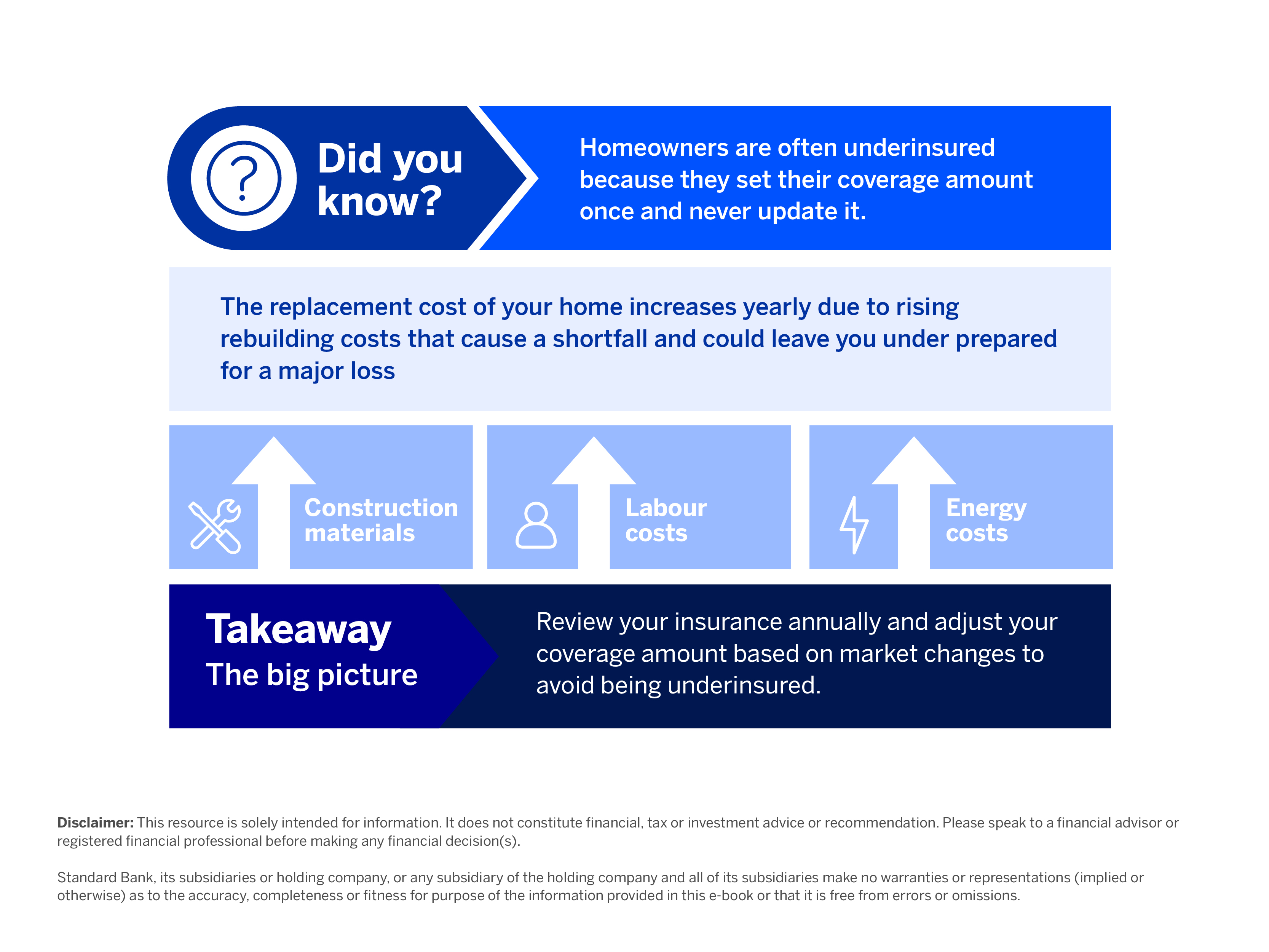

While often a mandatory requirement if you have a home loan, it remains a wise investment for any homeowner, safeguarding against unexpected accidents, fires or natural disasters. When setting up your policy, ensure your home is insured for its full replacement value (the cost to rebuild it from scratch), not its market value, to avoid underinsurance in the event of a major loss.

Learn more about insurance by downloading our free Insurance essentials e-book

What building insurance covers

Every policy is different, but most comprehensive plans include protection against the following:

- Fire, flood, water and storm damage

- Burst geysers or pipes

- Malicious or accidental damage to property

- Limited subsidence and landslip cover

- Fixed features such as swimming pools, tennis courts, water tanks and generators

While building insurance protects against unforeseen events, it's important to remember that policies generally do not cover damage caused by gradual deterioration or insufficient maintenance. Proactive property upkeep is crucial to both preserve your home's condition and ensure your insurance remains effective for the risks it's designed to cover.

Building insurance also excludes the following:

- General wear and tear or gradual deterioration

- Damage due to lack of maintenance or pest infestations

- Damage caused by illegal activities or intentional damage by the policyholder

- Damage that occurred before the policy started

Some insurers also offer optional cover for full subsidence or additional risks at an extra premium. Always read your policy carefully to understand what is and isn’t included.

Building insurance isn’t just a bank requirement; it’s a responsible financial choice that gives you the confidence that, no matter what happens, your home and your future are protected.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.

Yes, even after your home loan is settled, your property remains vulnerable to natural or accidental damage. Insurance protects your investment and saves you from unexpected costs.

No, building insurance only covers the structure and permanent fixtures of your home. To protect furniture, appliances and personal belongings, you’ll need home contents insurance.

It’s important to review your cover regularly. Renovations or property improvements can increase your home’s value, and you’ll want to ensure your policy covers the full rebuild cost.

Yes, you can change providers as long as your home loan agreement allows it. Be sure to compare cover benefits, exclusions and service quality, not just the premium amount.