A guide to choosing your cover: Comprehensive vs third-party insurance

Besides being essential to you getting around, a car is a big purchase that will take up a fair bit of your budget each month. If something happened to your car, it could cause serious disruptions not only to your lifestyle but also to your bank account, which is why it’s important to have insurance and protect yourself against such unexpected costs.

While insurance can seem complicated and balancing the right amount of coverage with your budget can be tricky, understanding the different types and how the coverage works will help you choose the right one for your needs.

Learn what you need to know about insurance.

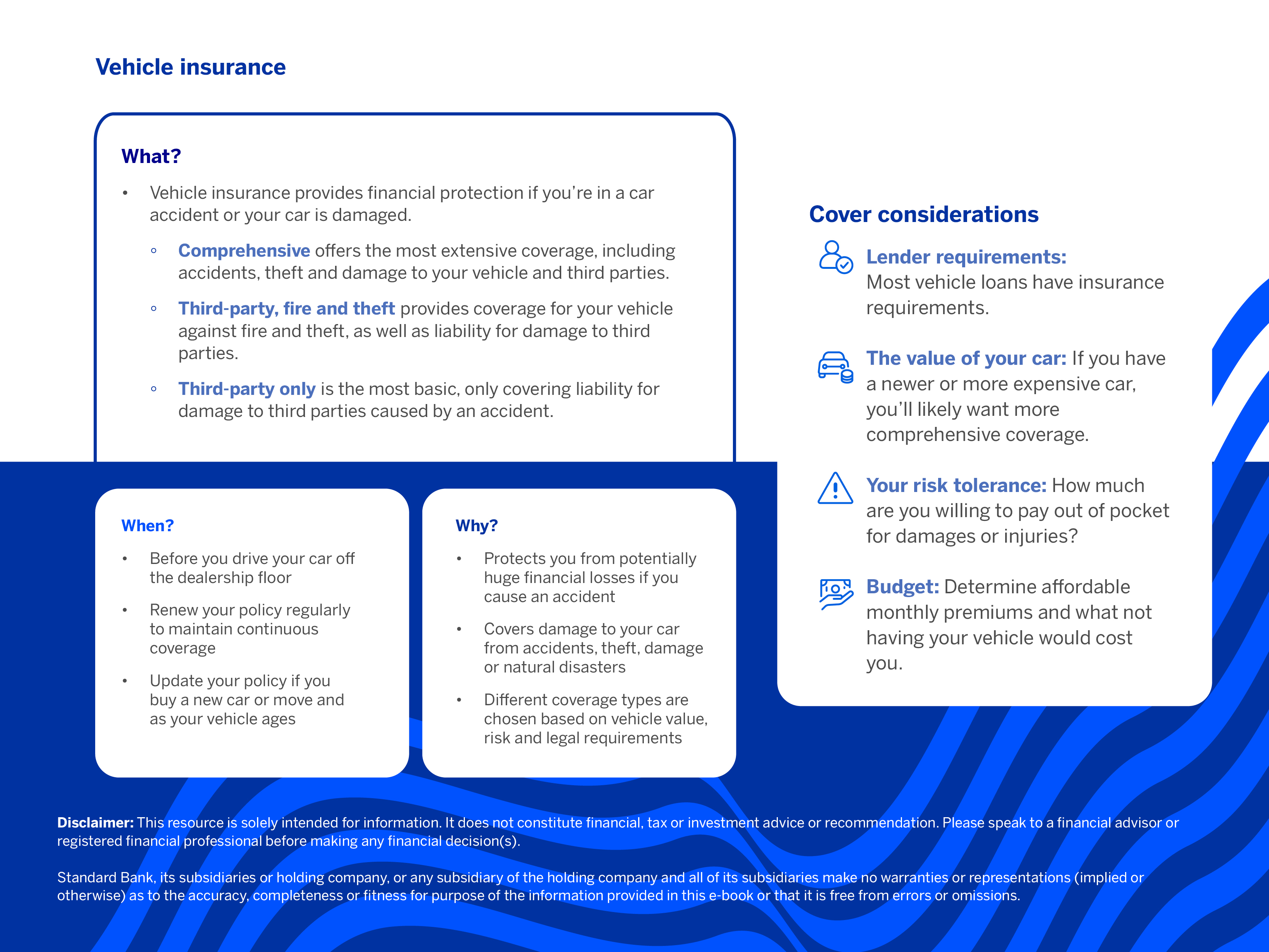

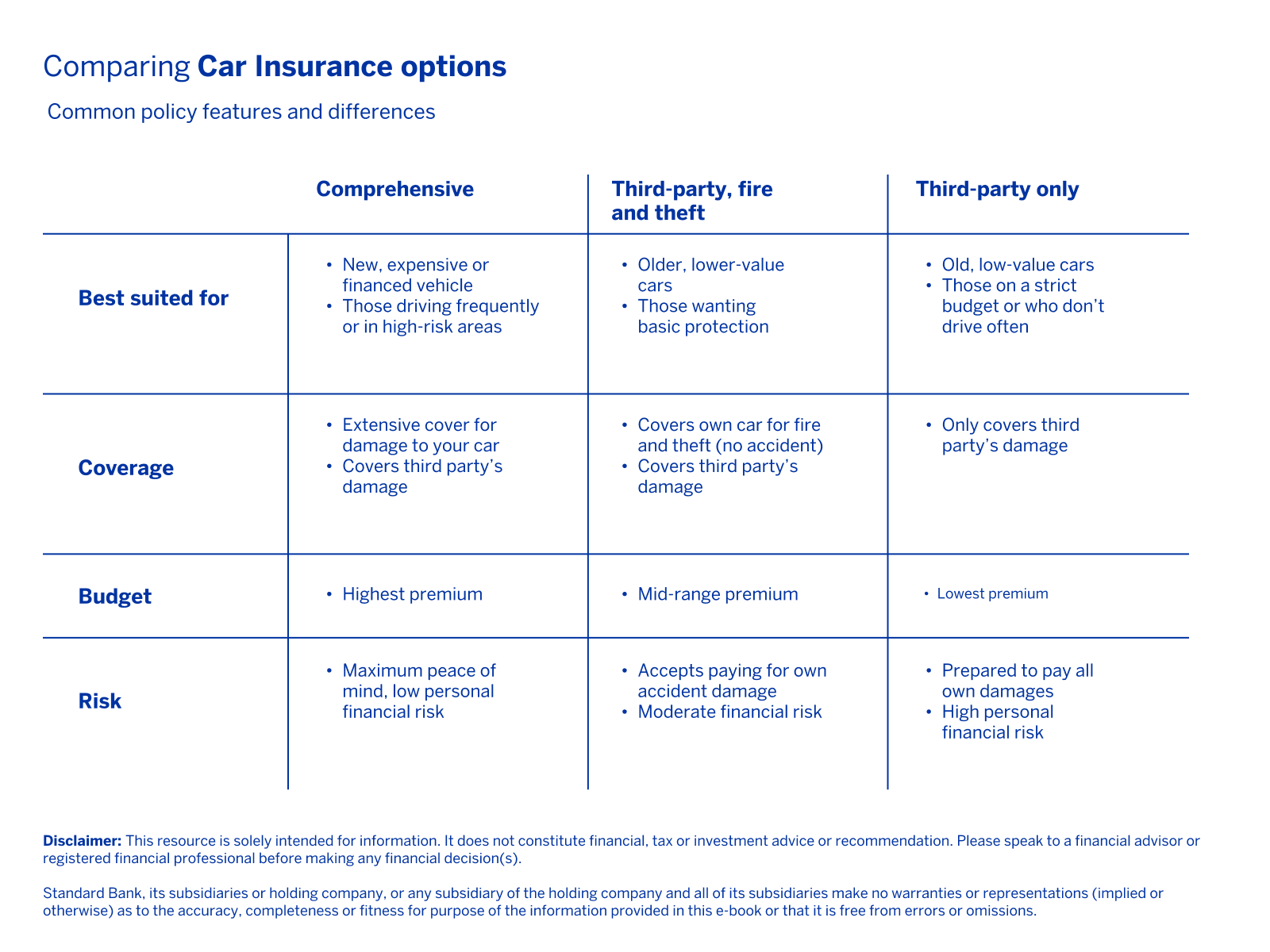

Comprehensive insurance

Comprehensive insurance provides the most extensive cover available, offering protection from a wide range of damages and losses. This includes incidents where your car is involved in a crash (regardless of fault), there’s a fire, it gets broken into or stolen or if it’s damaged due to a natural disaster such as floods or hail.

What makes it truly all-inclusive is that it covers both damage to your own vehicle and any damage or injury you might cause to another person's vehicle or property (third-party liability).

It’s considered the premium option as it gives you full protection and the widest range of cover, offering peace of mind regardless of who or what caused the damage or loss. For example, if a tree falls on your parked car, comprehensive insurance will cover the repairs. Furthermore, it’s typically a requirement if you want to finance a vehicle with a bank or other financial institution.

While comprehensive cover is extensive, it's important to note that certain aspects might be separate add-ons. For instance, personal accident cover for your own medical expenses, roadside assistance or cover for uninsured motorists might not be automatically included and could require additional coverage.

Limited cover: Third-party options

These insurance options limit your cover to specific events, primarily focusing on damage or injury you cause to others. They are generally more economical but offer significantly less protection for your own vehicle.

- Third-party only

This is the most basic option and only covers the cost of repairing damage to another person's vehicle or property if you are at fault in an accident.

Crucially, it doesn’t cover any damage to your own car, and you would be entirely responsible for the repair or replacement costs out of your own pocket. For example, if you accidentally reverse into someone's fence, your third-party insurance will pay for the fence repairs, but your own car's bumper damage would not be covered.

- Third-party and loss or damage from theft or fire

This option builds upon third-party only cover by adding protection for your own vehicle in specific circumstances: fire and theft.

Therefore, you’re covered for damage you’ve caused to someone else’s vehicle or property, just like if your car is stolen, hijacked or damaged due to fire, your insurance will cover the costs. For instance, if your car is stolen from your driveway, this policy would help you replace it. However, if you cause an accident and your car is damaged, the repairs to your own vehicle would still not be covered.

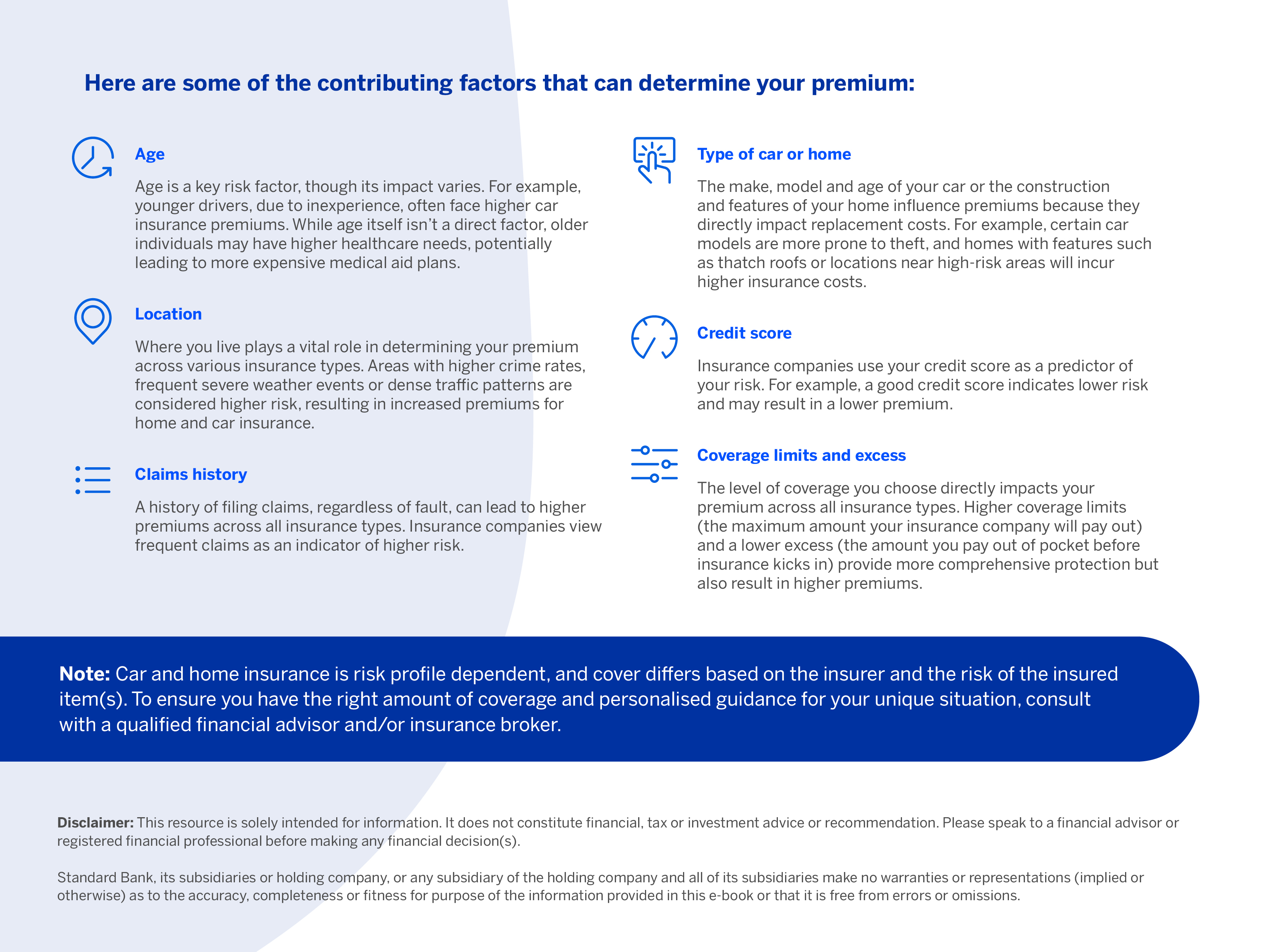

The cost of cover

Vehicle insurance premiums are personalised and calculated based on factors such as your age, driving history (including any no-claims bonus) and overall risk profile.

It also considers the type of vehicle you drive, your location, how you use the car and the excess amount you choose; opting for a higher excess can reduce your premium, though you'll pay more out of pocket if you make a claim.

Ready to get covered?

Get in touch with our insurance specialists today to get a quote on the right insurance option for your needs.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.