Your guide to life insurance beneficiaries

Life insurance is a cornerstone of financial planning, designed to provide a vital safety net for your loved ones after you're gone. A crucial but often underestimated step in setting up your policy is nominating your beneficiaries, the individuals or entities who will receive the financial payout.

While it might seem like a straightforward decision, carefully choosing and maintaining your beneficiaries is important, ensuring your legacy is managed according to your wishes and that your family receives the support they need, precisely when they need it most.

This guide explores the critical reasons behind this decision and answers common questions about life insurance beneficiaries.

Why choosing your beneficiaries is a big decision

Choosing your life insurance beneficiaries is far more than a mere administrative task; it's a foundational decision that underpins the entire purpose of your policy. Here's why:

- Honours your intentions: It dictates who receives the financial support you've planned, ensuring your legacy aligns with your wishes.

- Provides immediate financial security: You ensure that your spouse, children or other dependants have the resources to cover daily living expenses, pay off debts (such as a bond or car loans), fund education or maintain their standard of living after you're gone.

- Streamlines access to funds: Properly named beneficiaries generally bypass the lengthy and often costly estate administration process, ensuring funds reach your family quickly and privately.

- Prevents family disputes: Clear beneficiary designations reduce the potential for conflict among family members. When your wishes are explicitly stated, there's less room for arguments over who should receive the money, easing an already difficult time for your loved ones.

- Addresses specific needs: It allows for careful planning for minors or dependants with special needs, ensuring their inheritance is managed appropriately without jeopardising other benefits.

Whom can I nominate as my beneficiary?

You have the flexibility to choose almost anyone or any entity as your beneficiary. This could include family members, friends, a trust or even a charity. When making this crucial decision, consider not only who relies on you financially but also whom you wish to support emotionally or practically. Think about the following:

- Who depends on you financially for their livelihood or future?

- Who might incur funeral or estate costs that you wish to alleviate?

- Any family member, loved one or organisation you’d like to provide for or benefit after your passing

Can I have more than one beneficiary?

Yes, you can nominate multiple beneficiaries (the exact amount depends on your policy) and specify the percentage share each person will receive from your life insurance payout.

For example, you might allocate 50% to your spouse and 25% each to your 2 children. This helps ensure your payout is divided precisely according to your wishes and the specific needs of your loved ones.

Can I change my list of beneficiaries?

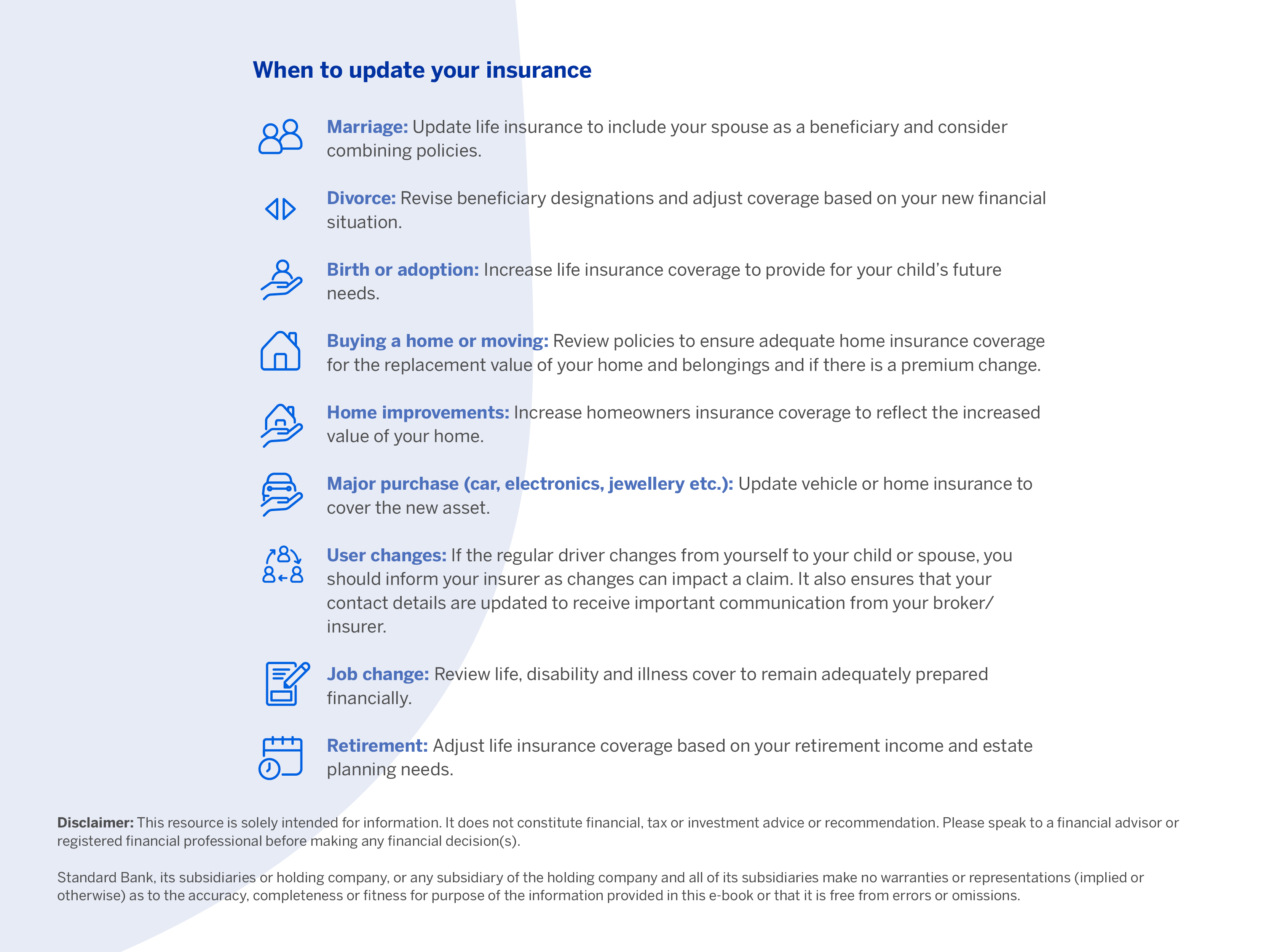

Yes, as the policy holder, you can add or remove beneficiaries whenever you want to. Life changes, marriages, births, divorces or even the passing of a loved one may affect whom you want to benefit from your policy.

It’s a good idea to review your beneficiaries at least once per year or after major life events to ensure your policy remains aligned with your current wishes and financial priorities.

Can I nominate a minor as a beneficiary?

Yes, you can nominate a minor as your beneficiary. However, know that minors can’t directly receive or manage large sums of money. If your beneficiary is still a minor when the claim is finalised, the benefit will typically be paid out according to instructions issued by their legal guardian. This might involve transferring the funds into a trust account or a specially designated minor's bank account, managed by the guardian.

To ensure your child's inheritance is properly protected, managed and accessible when needed, it is strongly advised to consult with a financial adviser or legal professional before naming a minor directly. They can help you explore options such as setting up a formal trust, which provides greater control over how and when the funds are distributed.

What happens if my beneficiary dies before me?

If a beneficiary passes away before you do and you haven't updated your policy, their designated portion of the payout will typically revert to your estate. This means the funds would then be subject to the estate administration process, causing delays and potentially not reaching the people you would have wanted.

This can be prevented by naming contingent beneficiaries, which are secondary beneficiaries who will receive the payout if your primary beneficiaries are no longer alive or can’t be located. For example, if your brother is the beneficiary, you can dictate that if he is no longer around, the money will be paid out to his wife.

You can also proactively regularly review and update your designations with your insurer. This simple step ensures your wishes are always upheld and prevents complications and delays for your loved ones.

What happens if I don’t nominate a beneficiary?

If you don’t nominate a beneficiary on your life insurance policy, the benefit will automatically be paid into your estate upon your passing, and the funds will become part of the overall estate settlement process.

This can significantly delay the payment of funds to your loved ones, potentially for months or even years, precisely when they need financial support the most. Nominating clear beneficiaries is the most effective way to ensure faster, direct access to these vital funds.

Can my beneficiaries refuse the payout?

Yes, although it’s rare, a nominated beneficiary can refuse to accept the payout. In that case, their share will be redirected to your estate or other beneficiaries, depending on your policy terms.

Choosing your beneficiaries and keeping those details updated is one of the most important steps in ensuring your loved ones are financially secure when you’re no longer around. Take time to review your beneficiary nominations regularly and speak to a financial adviser or legal professional if you need guidance to ensure your policy reflects your current family structure, financial priorities and peace of mind.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.