Why car and asset loan protection matters

Whether it’s your first set of wheels or an upgrade to something new, buying a car or a motorbike is an exciting and often significant decision. While you might’ve planned your repayments carefully, life can be unpredictable, and unexpected events, such as job loss, illness or disability, could make it difficult to meet your loan obligations.

In such situations, vehicle loan protection insurance can keep your wheels rolling and provide crucial financial relief, ensuring your vehicle instalments are covered.

What is car and asset loan protection insurance?

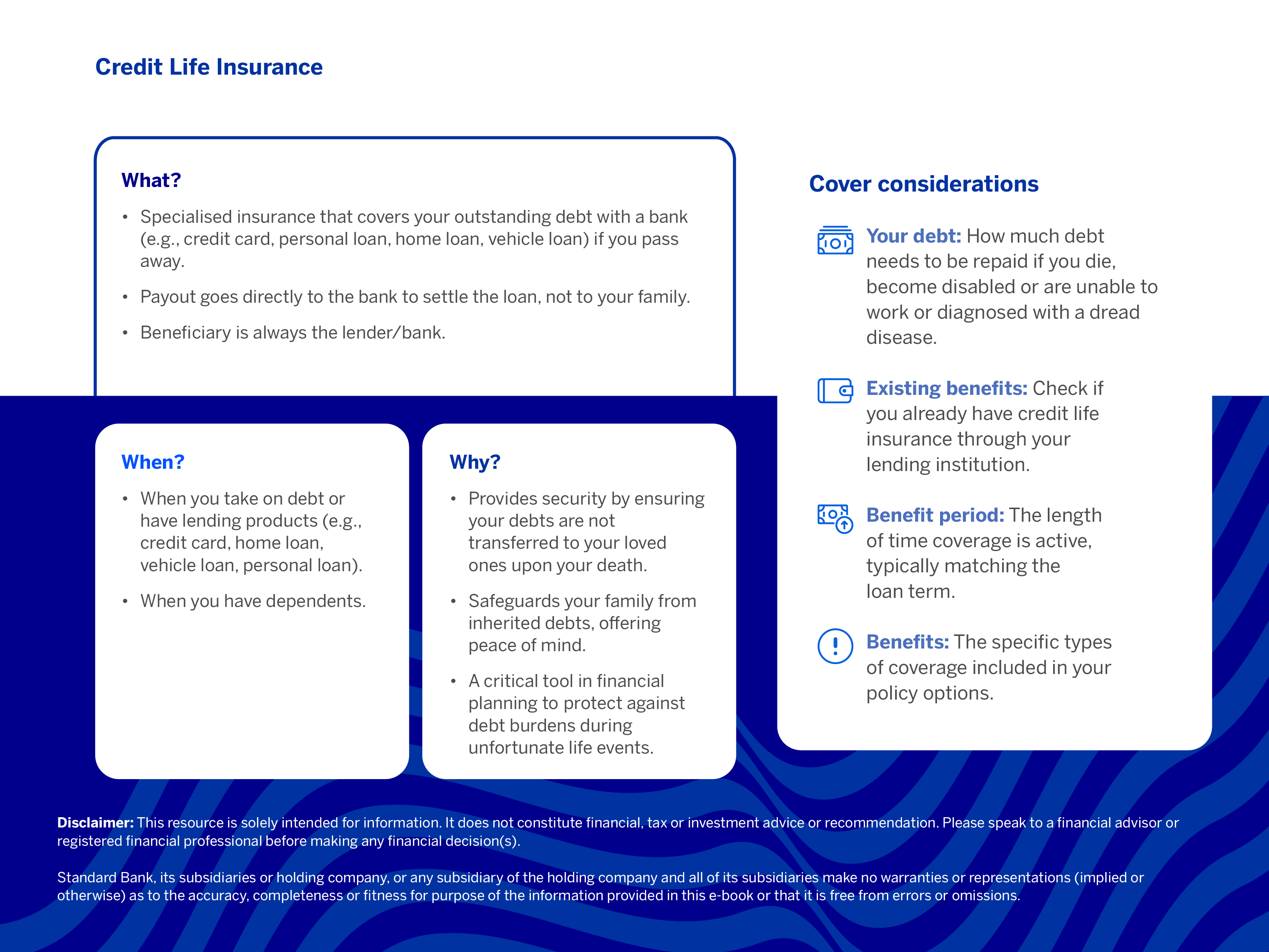

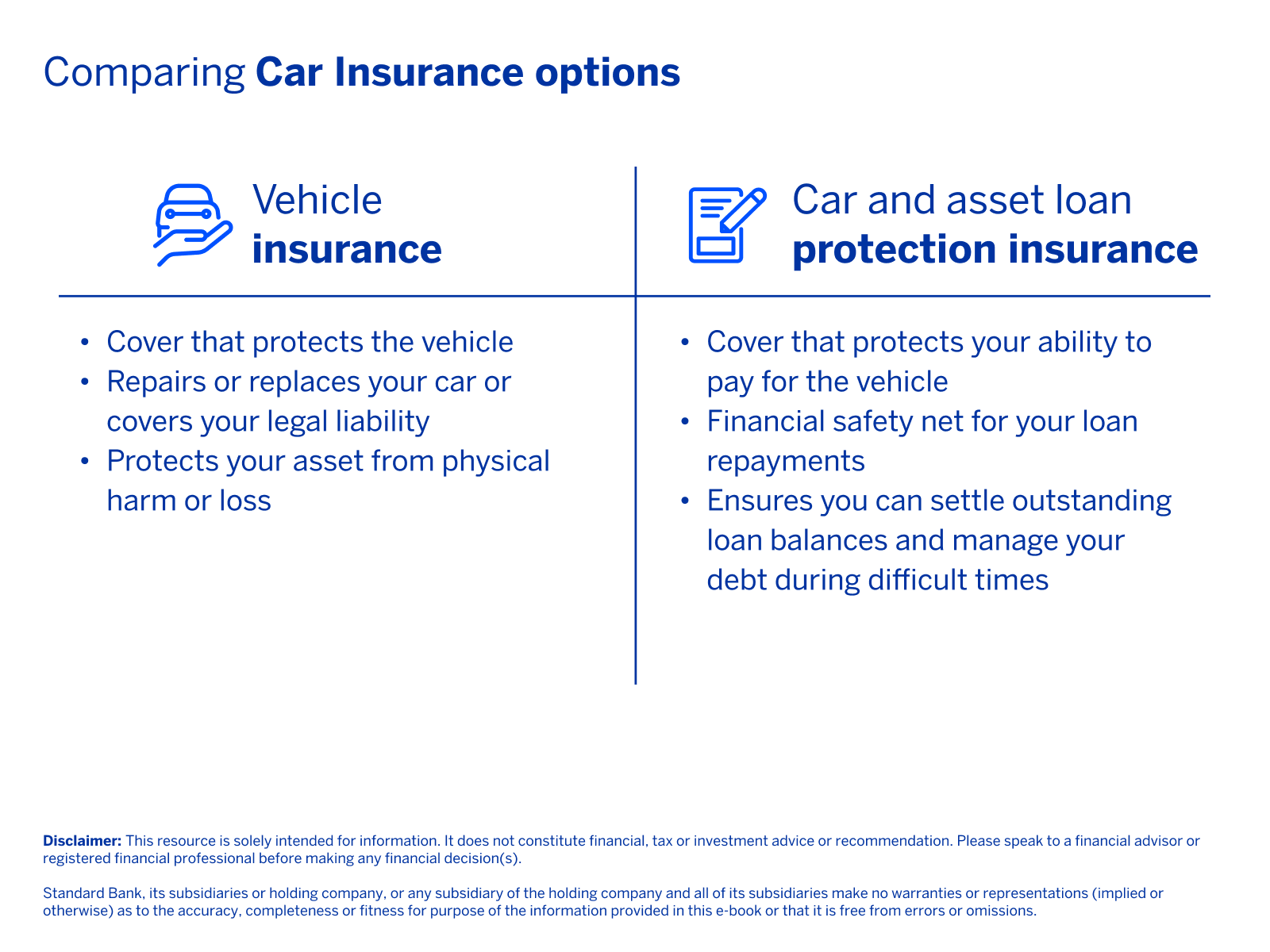

Car and asset loan protection insurance (sometimes also known as vehicle finance protection) is a specific type of cover designed to settle your finance agreement for a vehicle or other asset in the event that you are no longer able to make your repayments due to specific unforeseen circumstances. Its primary purpose is to protect you and your family from inheriting debt, ensuring your loan is settled and you're left debt-free.

This type of protection falls under the broader category of credit life insurance, which is insurance designed to cover outstanding debt on various credit agreements (such as personal loans, mortgages and vehicle finance) in the event of death, disability or other specified life events, such as retrenchment or loss of income.

What does it cover?

Car and asset loan protection insurance is designed to mitigate the financial risk associated with major life events that could prevent you from earning an income and, consequently, making your loan repayments.

While the exact terms differ between insurers, this type of insurance generally covers the following events:

- Death: Your remaining vehicle or asset loan balance is settled if you pass away, helping your family avoid additional financial stress

- Permanent disability: If you become permanently disabled and unable to work, the insurer will pay off your remaining loan balance

- Dread disease: In the case of a serious illness (as defined in the policy), the outstanding amount is paid to your lender

- Retrenchment: If you lose your job involuntarily, your monthly instalments may be covered for a limited period (e.g. up to 6 or 12 months), giving you time to recover financially

When would you need it?

You should consider vehicle loan protection insurance if you’ve financed your vehicle through a bank or lender. It’s particularly useful if you have dependants or co-signers as it prevents your debt from transferring to them. This cover can also provide peace of mind if your job or health situation changes unexpectedly, helping you stay financially secure.

Learn more about insurance, when you need it and why.

How is it different from vehicle insurance?

Vehicle insurance protects your car or motorbike, ensuring it gets fixed or replaced. Car and asset loan protection insurance protects your finances and your loan, making sure your debt is managed even when life throws unexpected challenges your way.

Is vehicle loan protection insurance mandatory?

While it’s not always compulsory, most financial institutions require some form of credit life insurance when granting a loan. This ensures that both you and the lender are protected. You can usually choose your provider, so it’s worth reviewing what coverage best fits your needs.

When does the cover end?

Your car loan protection insurance usually ends under the following circumstances:

- Your vehicle and asset finance loan is paid off

- Your vehicle and asset finance loan is cancelled

- A benefit for death, permanent disability or dread disease is paid

Usually, you can also select the period of time for which you want the cover. This is generally aligned to the outstanding term of your credit agreement but can also be extended to cover your full life.

Explore how our car and asset finance protection plan helps to ensure your vehicle loan commitments are covered even when life doesn’t go as planned.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.