What is credit life insurance, and why do I need it?

Life can bring unexpected challenges, sometimes impacting our ability to manage financial obligations. If you have loans, have you considered what would happen to them if you were to lose your job, experience a serious illness, become unable to earn an income or pass away?

Credit life insurance is a way for you to ensure that your debts can still be paid if the unthinkable happens and that they don't become a burden for you or your loved ones during difficult times.

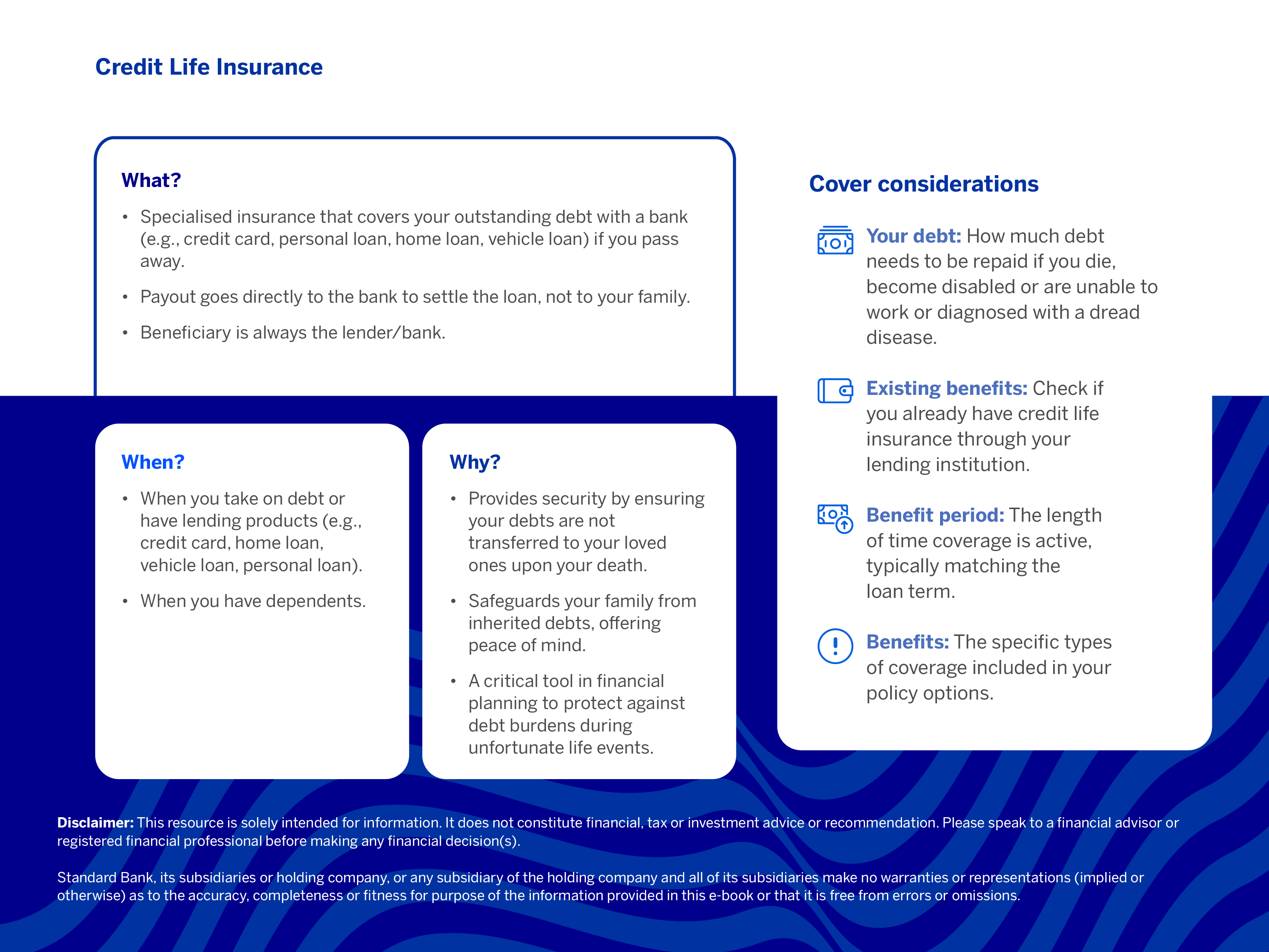

What is credit life insurance?

Credit life insurance is a specialised type of insurance policy designed to protect borrowers and their families. Unlike traditional life insurance, which pays out to a designated beneficiary, credit life insurance is specifically tied to a loan.

Its primary purpose is to cover your remaining debts should you face unforeseen circumstances, such as accidents and illnesses that may cause disability or prevent you from earning an income, retrenchment or death.

The insurance payout is directed straight to your lender (the bank or creditor) to settle the outstanding debt, rather than going to your family. This means your financial responsibilities are taken care of, preventing your loved ones from inheriting your loans. In essence, it offers protection against unexpected events, ensuring that your financial commitments are managed if the worst were to happen.

Why is credit life insurance important?

The primary role of credit life insurance is to provide borrowers with invaluable peace of mind and financial security. It’s a critical financial planning tool because it provides the following:

- Debt relief for your loved ones

The most significant benefit is ensuring your family isn't burdened with your debts during an already difficult time. The policy pays off your outstanding loan balance, safeguarding your loved ones from inheriting those financial obligations. - Financial security during hardship

Should you become temporarily or permanently disabled, unable to work or retrenched, credit life insurance can cover your loan payments or even pay off the debt entirely. This protects your assets and credit rating when you're most vulnerable. - Reduces stress and anxiety

Knowing that your major liabilities are protected in case of unforeseen events can significantly reduce stress and anxiety. This allows you to focus on your health, wellbeing or finding new employment without the added pressure of looming debt repayments. - Cost-effective as you pay down debt

Since premiums are often calculated based on your outstanding balance as your debt reduces, so do your payments, making it an adaptable and cost-effective solution. - Swift resolution

Credit life protection plans are designed for fast payouts (subject to policy terms) once an insured event occurs. This means your outstanding debts can be settled quickly, providing immediate relief and preventing delays that could impact your family.

Credit life insurance becomes particularly relevant when taking on debt (such as a home loan, vehicle loan, personal loan or even a credit card) and when you have dependants who rely on your income.

Types of credit life protection

Credit life insurance can be tailored to various types of lending products, offering specific protection for different financial commitments. These policies generally aim to cover the cost of your debt or the outstanding balance or provide repayment assistance for the associated loan in the event of an insured incident.

Home loan protection

Designed to cover the outstanding balance of your home loan, helping to ensure your family retains their home even if you're no longer able to make payments due to an insured event

Credit card protection

Ensures that outstanding balances are settled and your family isn't left with having to cover the cost of your credit card debt

Personal loan protection

Offers a safety net for various personal loans, including student loans, overdrafts or revolving credit plans, by covering the outstanding amount or providing instalment relief

Car and asset finance protection

Helps to settle the outstanding balance on your vehicle finance agreement or other asset loans, preventing repossession and keeping your assets secure for your family

Before taking out a policy, it's wise to consider the following factors:

- Identify your debt load and the total amount of debt you would need to repay if you were to pass away, become disabled, unable to work or diagnosed with a dread disease.

- Check whether you already have any credit life insurance through your current lending institutions or other policies.

- Understand the length of time you'll receive benefits while the underlying loan is active. The policy's term typically diminishes as the loan is gradually repaid, ceasing to exist when the loan is fully settled.

- Familiarise yourself with the general categories of benefits included in your insurance options, such as coverage for death, disability or retrenchment.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.

Your insurance essentials

Download our free e-book and get a better understanding of insurance, how it works and why you need it.