Disability cover 101

Life is full of uncertainties, and sometimes, those unexpected turns can impact our ability to earn an income. Disability cover is designed to provide crucial peace of mind during such times.

Here’s a breakdown of what disability cover entails, how it works and why it should be an essential part of your financial plan.

What is disability cover?

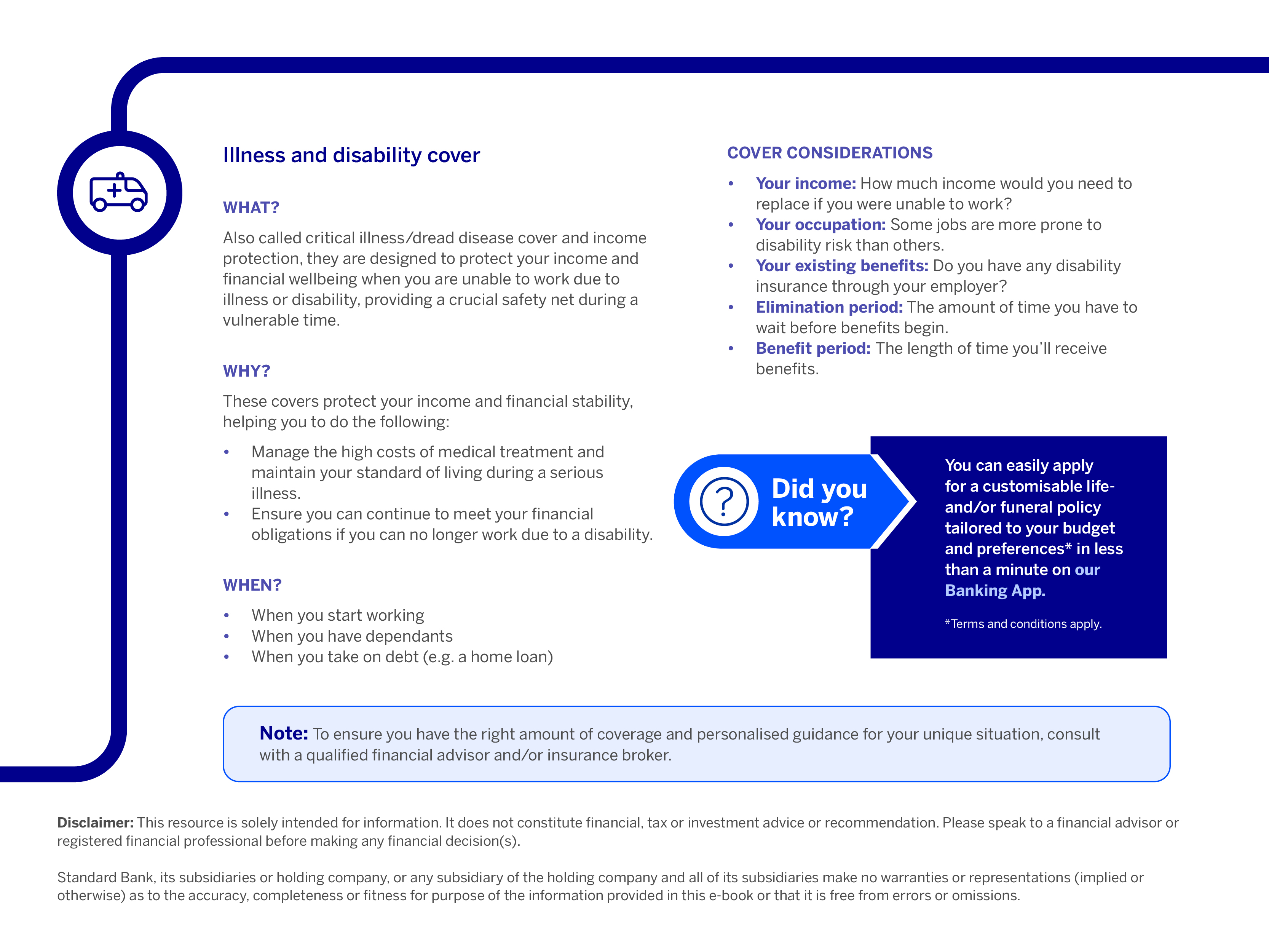

Disability cover is a type of insurance designed to provide financial security and stability when you can no longer earn an income due to a qualifying disability, such as losing your eyesight or a limb or becoming severely ill.

One of your most valuable assets is the ability to earn an income, and if that’s taken away, disability cover steps in to replace it.

Why do you need disability cover?

Being unable to make a living can significantly alter your lifestyle and your family’s financial security. Additionally, if you do become disabled, you could likely also have more expenses (medical and otherwise), which you’ll need financial relief for.

Therefore, disability cover is crucial for the following reasons:

- It helps you continue to pay for essential living expenses (e.g. your rent or bond, utilities, groceries, and car and student loan payments), preventing financial hardship and debt

- Knowing you have the necessary financial coverage can reduce stress and help you focus on recovery and moving forward

- Disability can occur in various ways (both accidental and illness related), and having the right coverage can give you peace of mind

Who needs disability cover?

Disability cover is important for anyone who relies on an income to cover their living expenses, but it’s especially important for anyone who has dependants because not only can your standard of living be affected but also the current and future financial security of your loved ones.

If you have significant debt, such as a home loan, student loan or car loan, you’ll need to have a plan to cover those expenses. Disability cover also offers extra financial padding when you don’t have an emergency fund or only have limited savings, so you won’t have to dip into debt to survive.

How much disability cover do I need?

Disability cover replaces (a portion of) your income with a once-off lump sum, but determining the right amount of disability cover is a highly personal exercise as it depends entirely on your unique financial situation and future aspirations.

To get a clear picture, you'll need to assess your current monthly expenses, outstanding debts and all your financial obligations to understand what you'd need to maintain your lifestyle and cover essential living costs if your income stopped.

You also need to consider how your salary might have grown over time, the evolving needs of your dependants and your long-term financial goals. Balancing these needs with what you can realistically afford in premiums is key.

This is precisely why seeking professional guidance from a qualified financial advisor or insurance broker is invaluable; they can help you navigate these considerations and tailor a solution that truly protects your future.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.

Have more questions?

Download our free Insurance essentials e-book and learn more about the different types insurance to help you protect yourself and your loved ones.