Should I save or pay off my student loan first?

When you’re trying to move forward in life, such as buying a house or a car, but still have student debt, it can feel like you’re stuck at a crossroads. Do you start saving for a deposit or tackle your student loan first?

These are competing demands on your resources, and it can be difficult to decide which to prioritise, where to start or whether you want to do both at the same time. This is a common financial dilemma, particularly for young professionals or if you have decided to further your studies mid-career.

The good news? You don’t always have to choose one over the other. With the right strategy, you can make progress on both.

What will influence your decision?

Your decision will be influenced by personal factors, such as the following:

- Your income and debt levels: Can you comfortably manage your debt repayments or contribute to savings? Is there enough money to do both?

- The impact of each approach: Think about how either option will affect your lifestyle and financial goals in the short- and long-term.

- Your personalised timeline: Are you hoping to be debt-free quickly, or is your focus on a major future goal, such as a rental deposit or buying property?

Once you’ve thought through these, you can weigh up the potential benefits of each approach:

| REASONS FOR PAYING OFF YOUR STUDENT LOAN FIRST |

REASONS FOR SAVING FIRST |

|

|

Deciding on a strategy

You might require a blended approach where you focus on the most urgent debts but still put a bit away for a rainy day.

Remember, starting small is still starting, and it will accumulate to create a bigger impact.

Step 1: Know what you’re working with

Get a clear picture of what you owe on your student loan and how much you would like to save.

Our home loan and student loan calculators can help you estimate your repayments and see how changes in interest rates could affect your monthly budget. They’re also useful for testing different scenarios, such as what happens if interest rates rise or if you choose a shorter or longer repayment period, so you can better understand how these factors affect your overall affordability.

Step 2. Assess your budget

Look at your monthly income, expenses and existing debts. This can give insight into where your money is going and where you might be able to cut back.

Ask yourself whether there are expenses you can reduce or remove and whether your spending habits are aligned to your current goals.

Tip: Try drawing up a simple list of wants versus need; for example, needs are groceries, rent and transport, and wants are subscriptions, frequent takeout and impulse purchases.

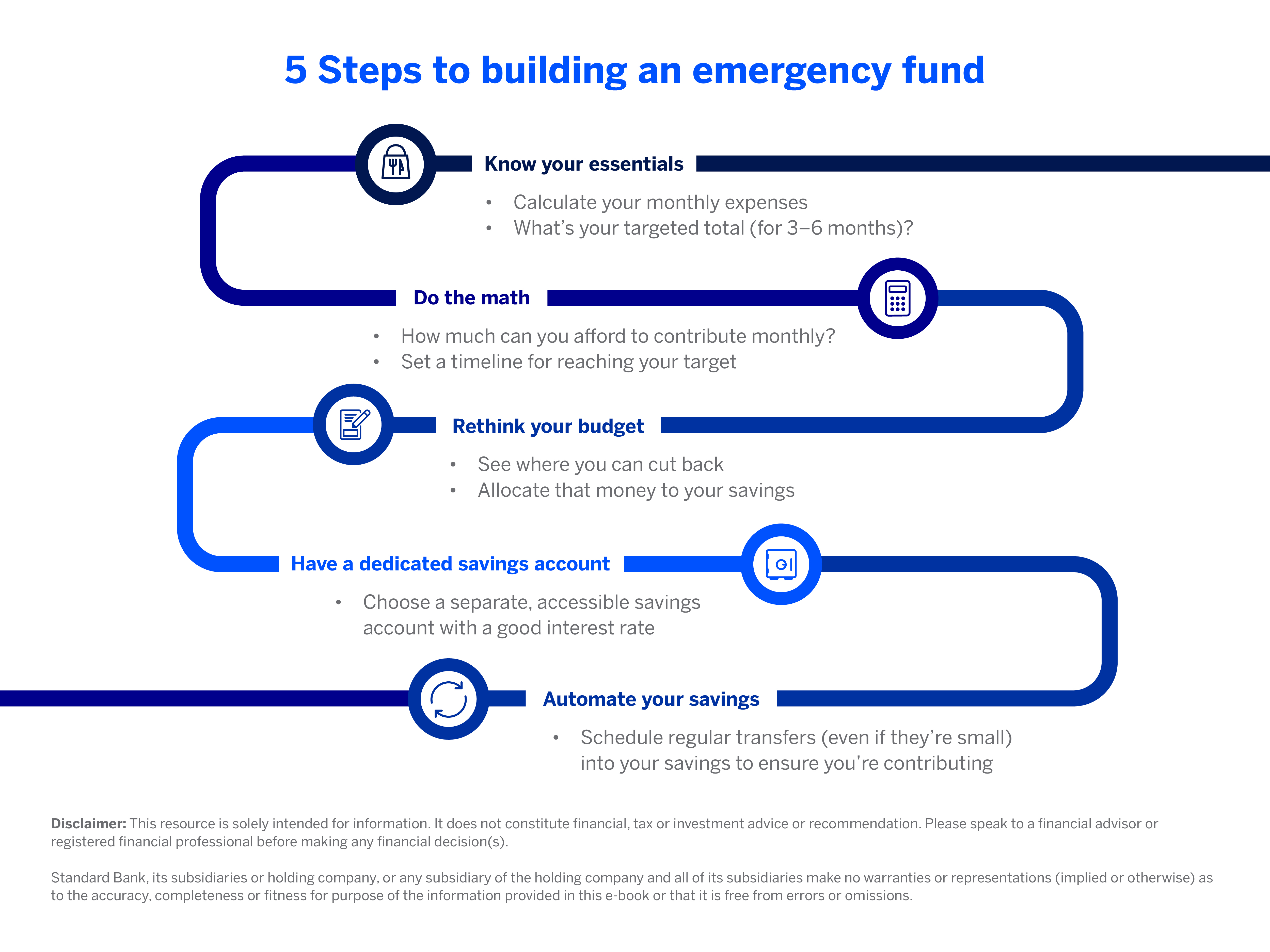

Step 3: What is an emergency fund, and why is it important?

Focusing solely on paying off debt without building any savings can leave you exposed to unexpected costs.

Even if it’s a small amount, building up an emergency fund is just as important. A cushion of just R5 000 can help you cover unexpected costs such as replacing a flat tyre, paying for urgent dental care or other medical bills without needing to take on more debt.

Remember, saving shouldn’t mean ignoring your student loan debt; it’s all about balance. Keep up with your student loan repayments to avoid penalties or added interest; however, you can still start saving in the process.

|

Use our Budget Manager tool on the Banking App to track your finances, set savings goals and monitor your progress, all in one place. |

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.

Learn how to manage your debt and use credit to your advantage.